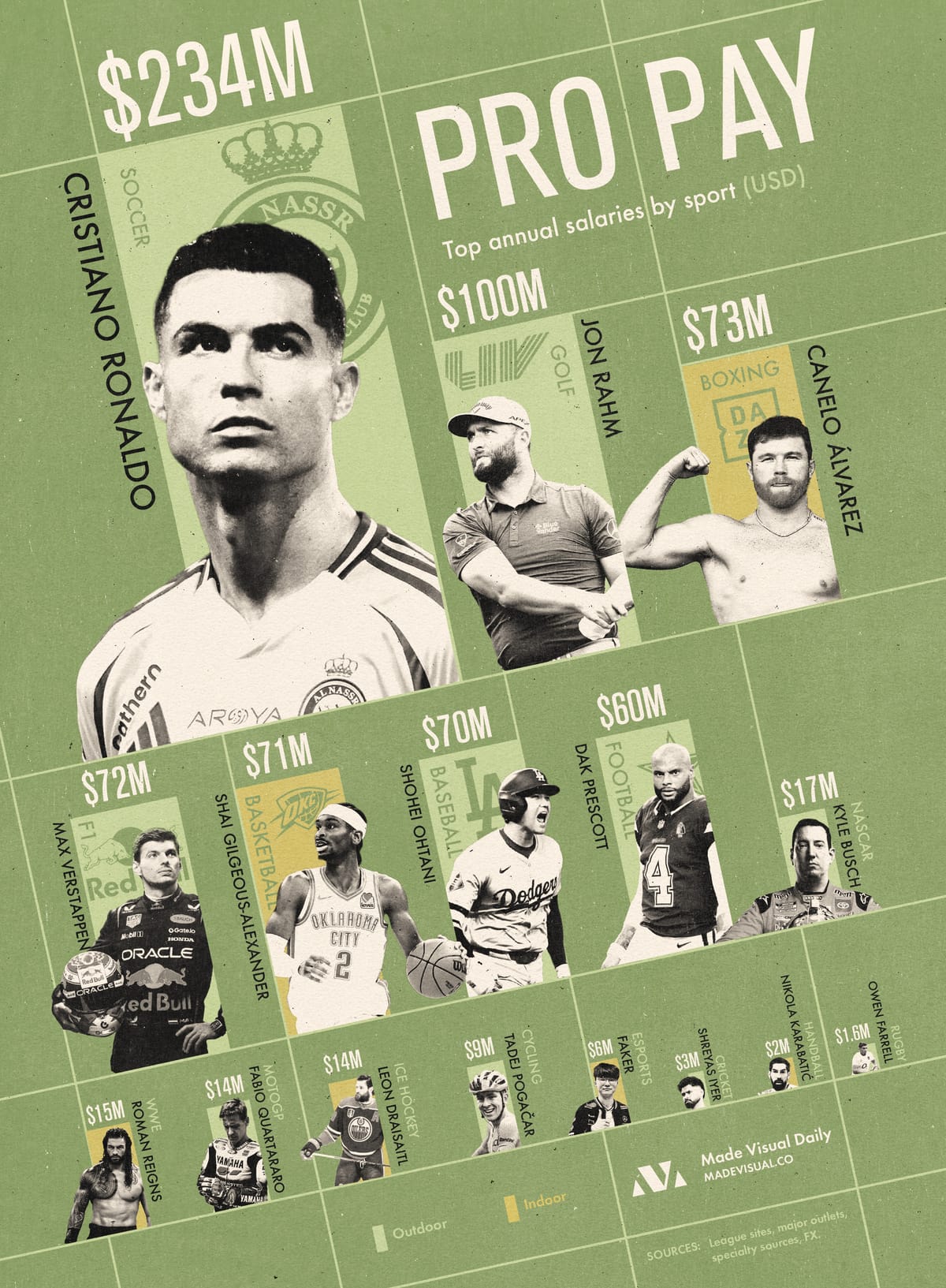

Chart breaking athlete salaries, per sport

In the era of streaming and sovereign money, uncapped, globally funded sports—not U.S. salary-capped leagues—now set the market ceiling for athlete pay.

Three more takeaways

- Star density drives pay. Sports where one person carries the whole product (boxing, golf, F1) funnel far more revenue to a single athlete than 50-man roster sports, so top AAVs skew to solo formats.

- Caps set the ceiling; media deals lift it. NBA/NFL top contracts rise mechanically with the cap, but individual-max rules keep them below uncapped peers; the next cap jumps will move basketball ahead of baseball on AAV rather than term length.

- Geography is a pricing lever. Sovereign-backed leagues and non-U.S. clubs can outbid capped teams; add FX swings and the same “€ figure” can jump U.S. rankings month to month.

Data & caveats

- List shows salary/contract AAV, not endorsements; that’s why a player’s total income can exceed the number here.

- Non-USD deals converted at recent FX; rankings shift with exchange rates.

- Some figures (NASCAR, WWE, esports) are credible estimates—not CBA-published salaries.

- Deal structures vary: deferrals (e.g., mega MLB contracts), incentives, and per-event purses change cash flow vs AAV.

- Seasons, fiscal years, and contract “start years” don’t always align; we standardize to a yearly rate for comparability.

Related facts

- 💸 NBA supermax = 35% of the cap for qualified stars—so every cap jump creates a new AAV record without renegotiation.

- 🏎️ F1 driver salaries sit outside the team cost cap, letting teams splurge on talent while trimming elsewhere.

- 🧾 Some record MLB deals pay single-digit millions in current cash with the rest deferred—headline AAV ≠ take-home this year.

- 🥊 Per-event sports can top a season’s salary in one night when PPV/back-end shares hit; AAV smooths that volatility.

- 🌍 The Saudi Pro League and LIV didn’t just raise offers—they reset the reservation price for global stars, forcing legacy leagues to rethink pay structures.