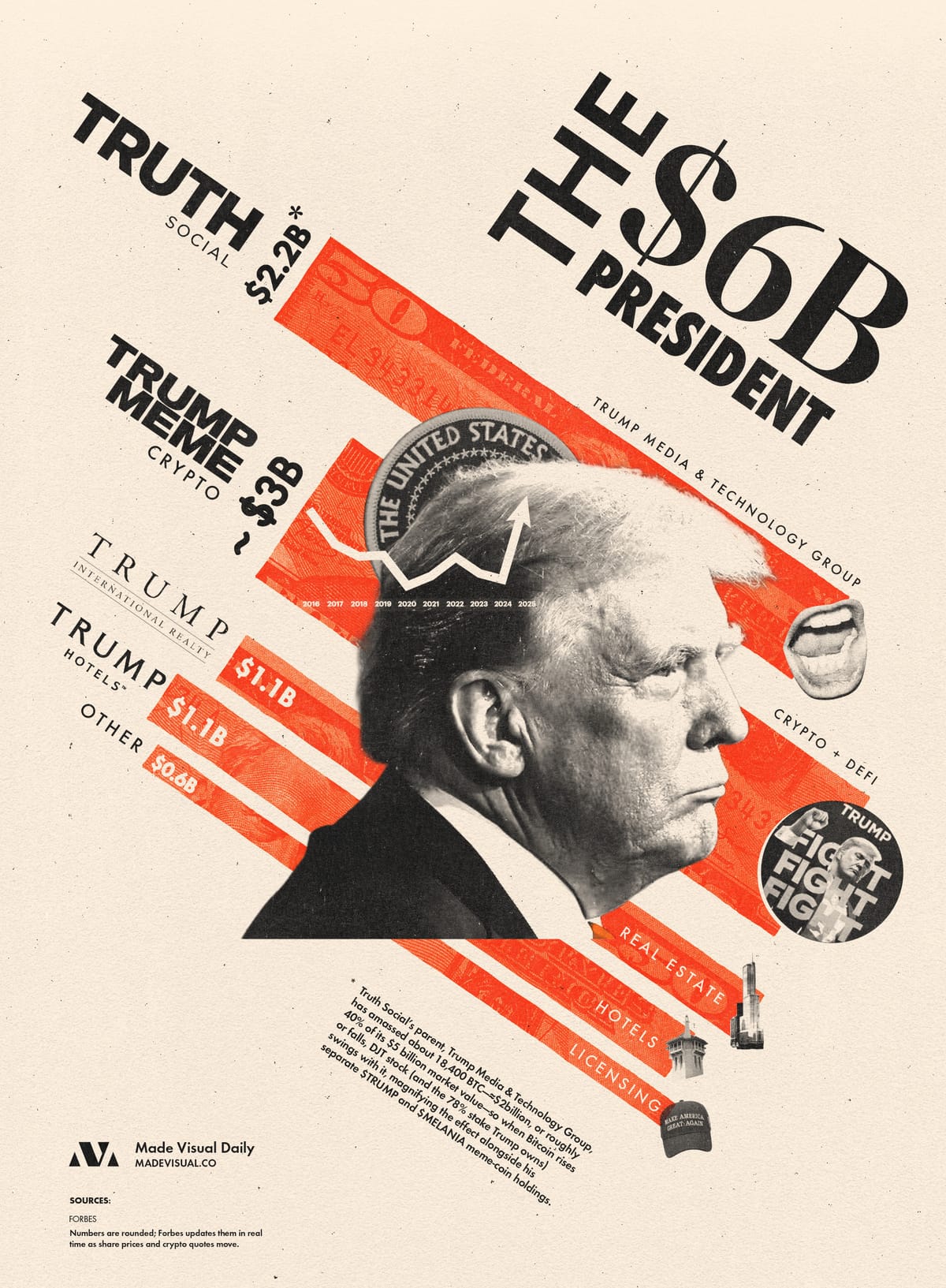

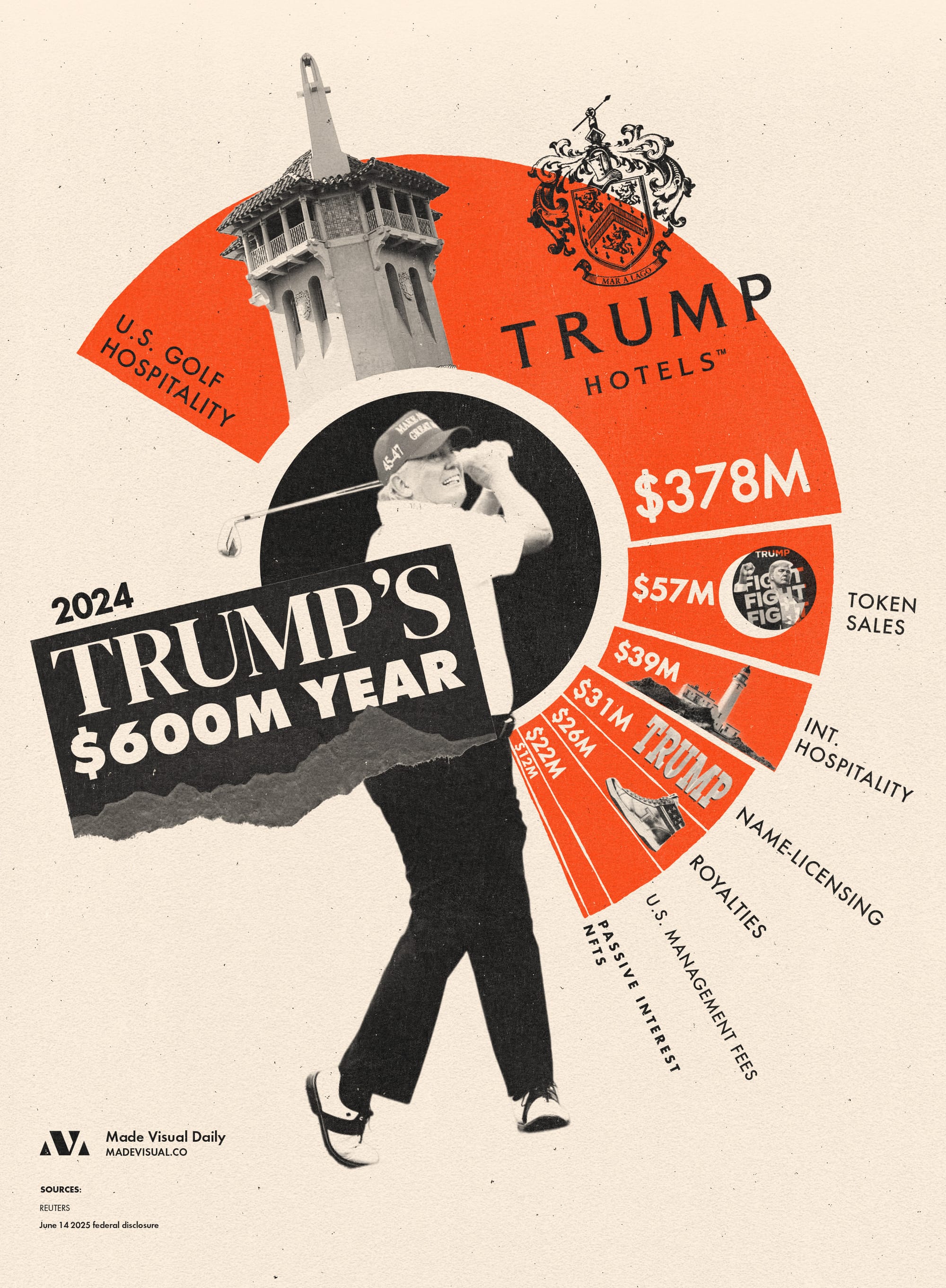

A breakdown of Trump's (largely crypto-driven) net worth and income

President Trump is a Crypto Billionaire (~$3B). Trump’s 2025 financial disclosures show that while his real estate empire is stagnant, he has quietly repositioned himself as a crypto whale and media stock speculator—placing him squarely in the middle of two of the most volatile, politically charged markets on Earth.

Other Takeaways

- His wealth is now tech-driven, not brick-and-mortar. Crypto and Truth Social stock account for over 90% of his estimated net worth.

- Licensing and branding remain his stealth cash machine. Even as physical assets plateau, global licensing fees quietly outpace many of his traditional businesses.

- He’s leveraged narrative as much as assets. The same markets that love volatility—crypto and meme stocks—are the ones he thrives in, blurring the line between political theater and financial gain.

Data + Caveats

- The $6 B headline valuation is at the high end; Forbes’ discounted estimate sits closer to $5.5 B.

- The $8 B sum is inflated because some of Trump’s crypto is tied up in assets (BTC) that also back Truth Social’s valuation, so counting them separately double‑counts the same underlying value.

- Truth Social’s $2.2 B+ valuation assumes current stock prices, which are highly speculative.

- Crypto holdings (≈$3 B) swing wildly with market prices and could shrink fast.

- Overseas licensing income is at least $36 M but may be underreported as filings give ranges.

- Income data is for 2024 only; actual annualized figures may differ.

Related Facts

🔹 Truth Social’s stock briefly gave Trump paper wealth rivaling tech billionaires—before correcting nearly 60% earlier this year.

🔹 His NFT trading cards sold out in minutes, proving his brand can still mobilize retail investors like a meme asset.

🔹 Foreign income streams from Dubai, India, and Vietnam raise ongoing conflict-of-interest concerns flagged by ethics watchdogs.

🔹 Trump Media’s market cap is driven by retail enthusiasm, not fundamentals—analysts warn of a “meme bubble” dynamic.

🔹 Political campaigns and legal battles create feedback loops: the more attention, the more volatility, the more potential upside in his market-linked wealth.